Image credit: Unsplash

As businesses navigate the complexities of the post-pandemic economy, the need for innovative risk management strategies is more critical than ever. One approach that has gained momentum since the pandemic is an 831(b) plan, a unique vehicle for managing risks and liabilities that can offer significant tax advantages and financial flexibility. As you look ahead to 2025, incorporating an 831(b) plan into your business strategy could be a game changer. Here’s why.

Understanding the 831(b) Plan

An 831(b) plan allows small businesses to establish a micro captive insurance company to insure their own risks. Unlike traditional business insurance, which involves transferring risk to third-party insurers, a micro captive insurance model enables businesses to retain and manage their risks internally. Under Section 831(b) of the Internal Revenue Code, small captives can provide insurance coverage for a variety of risks and receive certain tax benefits, making them an attractive option for many businesses.

“The 831(b) tax code was originally written in the 1980s when we were seeing a hardened insurance market much like today,” said Van Carlson, CEO and founder of SRA 831(b) Admin, one of the largest 831(b) plan administrators in the country. “Insurance companies have a low appetite to take on additional risks. Have you noticed how your policies are getting thicker? It’s not because they are adding coverage, it’s because they are adding exclusions. With an 831(b) you don’t have that issue, our policies are broadly written to self-insure your under or uninsured risk.”

Key Features of an 831(b) Plan:

- Mitigating risk more efficiently: Traditional insurers cover a large portion of the risks business owners face. However, as many business owners learned during the COVID-19 pandemic, their policies often limited or excluded coverage. There are also many losses that insurers will not cover. An 831(b) Plan mitigates the risks business owners take each day, whether they realize it or not.

- Customization: 831(b) Plans allows businesses to tailor their coverage to meet specific needs, ensuring better alignment with their risk profiles.

- Tax-deferred plan contributions: An 831(b) Plan allows a business owner to defer income to address tomorrow’s risks. Without an 831(b) Plan, business owners are self-insuring risks, such as a business interruption, with after-tax money from cash flow. With an 831(b) Plan, when catastrophe strikes, business owners can utilize these tax-deferred reserves to weather the storm.

- Investment Opportunities: Funds that would typically be paid as insurance premiums can be invested to grow the capital base, potentially yielding additional revenue.

- Improved Cash Flow: Businesses can control cash flow by retaining premiums instead of paying them to traditional insurance companies, allowing for more strategic financial planning.

The Business Case for 2025

1. Evolving Risk Landscape

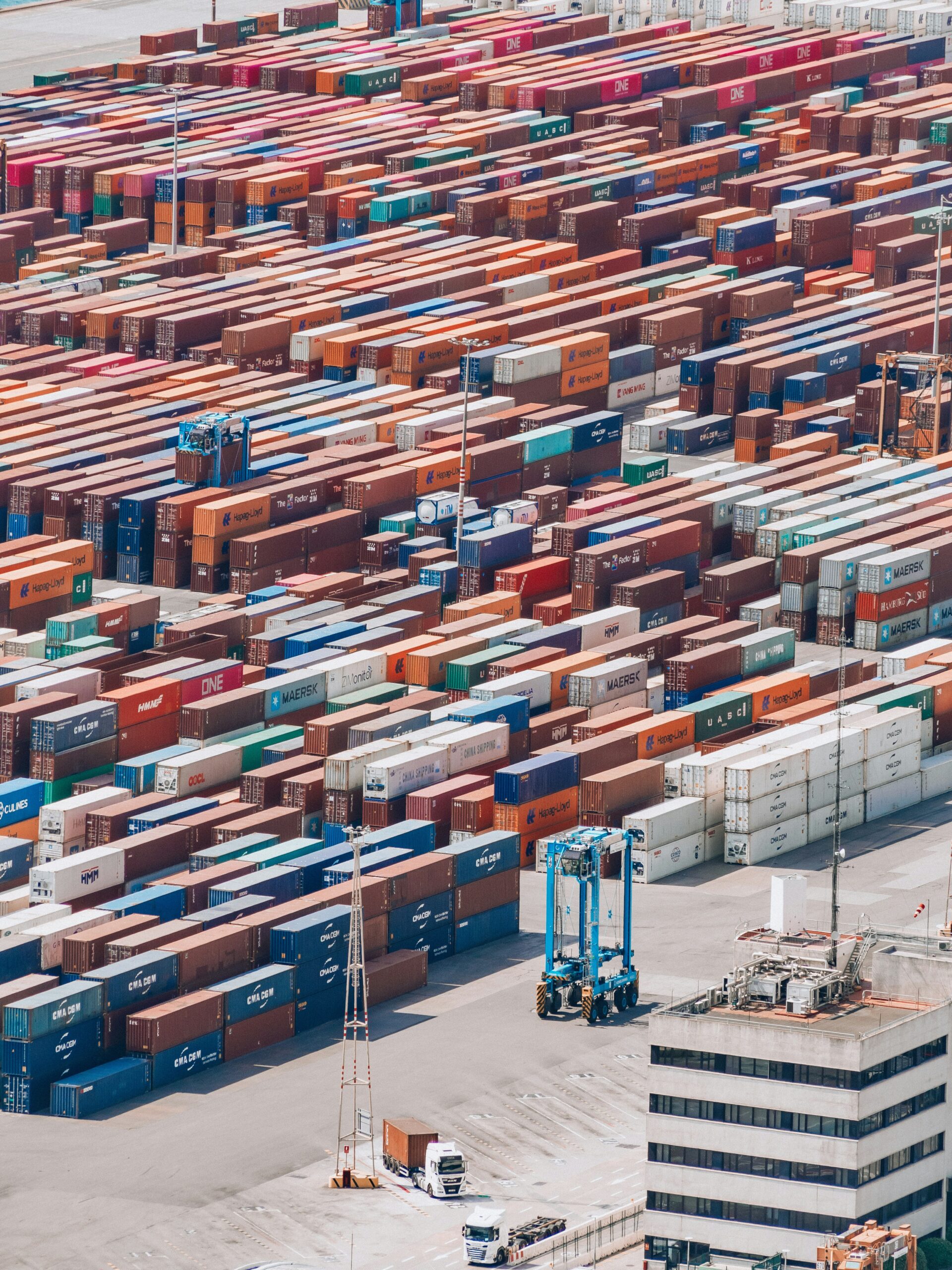

The business environment is becoming increasingly volatile, with new risks emerging from technological advancements, cyber risks, supply chain disruptions, brand reputation management, regulatory changes, and global economic shifts. A traditional insurance model may not cover the unique risks that businesses face today leaving businesses exposed. An 831(b) plan enables companies to proactively identify and manage these risks.

2. Enhanced Financial Resilience

As businesses prepare for the uncertainties of the future, financial resilience will be key. An 831(b) plan not only helps mitigate risk but also provides a financial buffer. The ability to invest retained premiums means that businesses can build a capital base that can be utilized in times of need, enhancing overall stability.

3. Competitive Advantage

Incorporating an 831(b) plan can provide a competitive edge by allowing businesses to manage risks more effectively than competitors who rely solely on traditional insurance. This proactive approach can lead to improved operational efficiency and can be a selling point when attracting clients or investors.

4. Strategic Growth

For businesses planning to expand, having an 831(b) plan can support growth strategies by providing the flexibility to cover new risks associated with scaling operations. Whether it’s entering new markets or launching new products, the ability to customize coverage is invaluable.

Implementation Considerations

1. Expert Guidance

Setting up an 831(b) plan involves navigating regulatory requirements and ensuring compliance with tax laws. It’s essential to engage experts in captive insurance, including legal, tax, and risk management professionals. SRA 831(b) Admin has a team of seasoned professionals that has built a book of business that spans the country because of its experience and has advised the IRS on best practices for managing 831(b) plans.

2. Risk Assessment

Before establishing an 831(b) Plan, businesses should conduct a comprehensive risk assessment to identify the risks they want to insure. This ensures that the plan is structured effectively to meet their specific needs.

“Businesses also need to reassess their risk exposures at least on an annual basis as the landscape continues to change,” Carlson said. “We make sure our clients are adequately covered when the unexpected happens. A risk now may not have been a risk a year ago.”

Conclusion

As we approach 2025, businesses must adapt to a rapidly changing landscape that demands innovative solutions for risk management. An 831(b) plan presents a unique opportunity to provide customized risk coverage, enhance financial resilience, and reduce tax liabilities. By integrating this approach into your business strategy, you position your organization not only to withstand potential challenges but also to thrive in an increasingly competitive market. Embrace the future of risk management—consider an 831(b) plan as part of your strategic vision for 2025 and beyond.

Written in partnership with Tom White.